FAQ

Clear up any confusion with our FAQs

The financial markets are constantly changing, and staying informed about market developments can help you stay ahead of the curve and make better decisions.

Trading is the process of buying and selling financial instruments, such as stocks, bonds, currencies, commodities, or CFDs, in order to profit from fluctuations in their prices.

There are various types of trading, including day trading, swing trading, and long-term investing. Day traders aim to profit from short-term price movements, while swing traders hold positions for a few days or weeks. Long-term investors hold positions for months or years, with the goal of earning returns over the long term.

Trading carries the risk of financial loss, as the value of financial instruments can fluctuate. It is important for traders to be aware of the risks and to have a solid understanding of the market before making any trades.

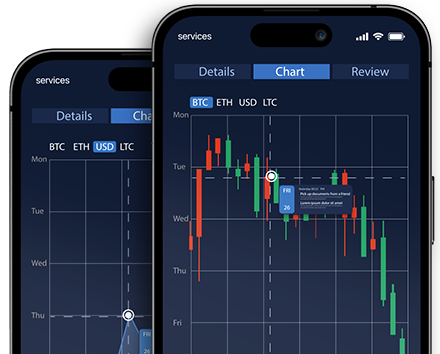

To start trading, you will need to open a brokerage account and deposit money. You can then use a trading platform such as Thaurus to place orders for financial instruments.

Some strategies for successful trading include setting clear goals and risk management strategies, staying up to date with market news and analysis, and diversifying your portfolio. It is also important to be disciplined and stick to your trading plan.

Technical analysis is a method of evaluating financial instruments by analyzing statistical trends and patterns in the market data. It can be used to identify trends, support and resistance levels, and potential entry and exit points for trades.

Risk management is an important aspect of trading, as the value of financial instruments can fluctuate. Some strategies for managing risk include setting stop-loss orders, diversifying your portfolio, and not investing more money than you can afford to lose.

There are many resources available for traders who want to learn more about the markets and trading strategies. These include educational materials offered by trading platforms such as Thaurus, online courses and webinars, and books and articles written by industry experts.

Some common mistakes made by traders include overtrading, not having a clear trading plan, not properly managing risk, and letting emotions influence their decisions. It is important for traders to be aware of these pitfalls and to strive to avoid them in order to increase their chances of success.

There are many factors that can impact the price of financial instruments, including economic news and events, government policies, and market sentiment. It is important for traders to stay up to date with these factors and to consider their potential impact on their trades.

Don't miss out on the great market opportunities

Join the world of trading and start building your wealth today!