Discover the Benefits of CFD Online Trading with Thaurus

CFD (Contracts for Difference) trading has gained popularity due to its unique advantages compared to traditional trading methods. Here are the key benefits of CFD online trading:

Leverage

The Thaurus CFD platform allows you to control huge positions with a small deposit. This multiplies returns and, of course, the attendant risk. This requires effective risk management.

Flexibility in trading strategies

Enjoy flexibility in trading strategies with Thaurus. Our CFD online trading allows one to go long or short an asset without actual ownership. This flexibility enables you to benefit from both rising and falling markets.

Access to a wide range of markets

Thaurus provides access to multiple markets via our CFD platform. Sell and buy different asset classes, from stocks to commodities, forex, and futures all from one seamless interface.

No ownership and associated costs

Trading CFDs without the cost of holding physical stock, be it for storage or purchase, among other factors.

Tax efficiency

Tax benefits may be realized when trading CFDs with Thaurus. In some jurisdictions, profits from CFDs will have alternative tax treatments than traditional investments. Depending on local regulations, that can mean lower tax liabilities.

Professional execution and tools

Thaurus enables the delivery of an elite level trading experience using an advanced CFD platform. Professional-grade execution, a variety of order types, and sophisticated risk management tools such as stop-loss limit, heatmap, currency convertor, and many more are all at your fingertips.

Advanced Trading Tools and Features at Thaurus

Thaurus offers a range of advanced trading tools and features specifically designed for CFD online trading, enhancing the trading experience and aiding in informed decision-making. Here are some of the key tools and features available:

CFD profit/loss calculator

This CFD profit/loss calculator from Thaurus is a very important tool in the trader’s arsenal. Using this calculator will give a guideline of what potential profits and losses could be incurred in any trade that a trader intends to take. You will easily forecast financial outcomes with the required precision by filling in the trade details, after which you can easily make much more informed and strategic trading decisions based on potential risks and rewards.

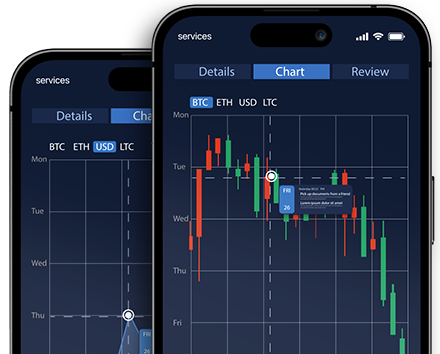

Real-time data and charts

Real-time market data and advanced charting tools from Thaurus will help in-depth technical analysis. This will keep you updated with the trends and movements of the markets as they occur, thus enabling you to make timely and knowledgeable trading decisions based on the current market.

Market analysis resources

• Thaurus offers a comprehensive and fully integrated suite of tools for market analysis that gives real-time market news, detailed reports on the analysis, and educational materials. All these resources are intended to assist in gaining further insight into the current market condition and its trends, thus arming you with the valued judgment for the execution of a successful trade involving CFDs.

Risk management tools

Thaurus brings together into one place various risk management tools, such as stop-loss and take-profit orders, designed to help you effectively keep your trading exposure under control. These tools are very instrumental in protecting your investments while being able to keep possible losses at bay, and hence, trading strategies are carried out within optimum risk controls.

User-friendly interface

Thaurus has a user-friendly interface that will put both novice and professional traders at ease. This includes all the customizable layouts that will allow one to adjust their workspace in such a manner as to give a seamless trading experience in line with one’s personal preference and trading strategies.

Diverse market access

Our CFD platform gives access to a wide spectrum of markets such as forex, commodities, and futures. With access to such diverse markets, a trader can develop different trading strategies for better portfolio diversification and be better positioned to react to changing markets and opportunities.

Real-Time Market Analytics

Thaurus offers a suite of real-time market analytics tailored for CFD online trading, providing traders with essential data and insights to enhance their trading strategies. Among its most remarkable features are the following:

- In-depth analytics: Obtain detailed metrics, such as volumes of buy/sell orders and VWAP, to understand the trend of the market.

- Real-time updates: Observe second-by-second to minute-by-minute updates on the market.

- Anonymized data: Friendly to privacy, it gives insightful data regarding market behavior.

- Accessibility: via web application or API for seamless integration into your trading setup.

- Cost efficiency: Saves you from the need for personal infrastructure and related maintenance costs.

- Multi-asset class: Cash markets and equity derivatives for completeness of data.

Secure and Efficient Trading Environment

Thaurus delivers a secure and efficient trading environment for CFD trading by combining advanced technology with robust security measures.

Secure trading environment

Data encryption

It makes use of state-of-the-art encryption protocols to protect sensitive information belonging to the user and transactions so that no third party can access it.

Two-factor authentication (2FA)

Additional means used to verify an identity in relation to the account accessed; for example, a user will need a mobile device to further verify the identity of the user.

Regulatory compliance

Ensure compliance with all applicable regulatory requirements to promote transparent trading practices in the safe management of users’ funds.

Efficient trading environment

Advanced trading tools

Encompasses a CFD profit/loss calculator and real-time market analytics to support real-time, informed decisions.

Real-time market data

Provides real-time market data and analytics, including buy/sell orders and VWAP metrics necessary for responsive trading strategies.

User-friendly interface

Easy to navigate, thus allowing access to many tools and features seamlessly, which enhances the efficiency of trading.

API access

Professional traders will have API access for the development of auto-trading strategies and customized analytics.

Cost-effective solutions

This will help reduce the requirement for expensive investments in infrastructure by providing end-to-end market analytics and data services, thus becoming an economical deal for all traders.

Get Started with CFD Trading at Thaurus

In a nutshell, Thaurus offers a state-of-the-art CFD trading platform that combines advanced features and real-time data in support of efficient CFD online trading. Its robust infrastructure and user-friendly design make it one of the strong choices a person can make toward engaging in dynamic activities on the markets. On its part, Thaurus combines innovation with reliability to deliver a comprehensive solution for handling intricacies related to CFD trading.