Features of Thaurus Futures day Trading Platform

Thaurus offers a comprehensive futures trading platform with several key features that cater to both novice and experienced traders:

User-friendly interface

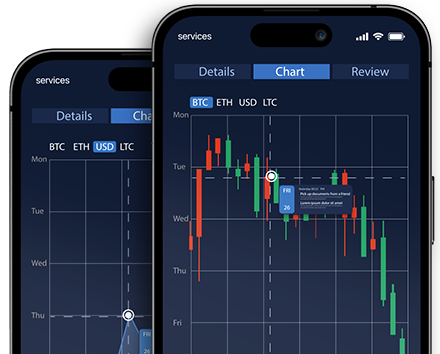

The intuitive and user-friendly interface of the Thaurus futures day trading platform allows traders of all experience levels to navigate it easily. The dashboard is clean and organized which helps you find the market you want to trade, utilize trading tools, execute orders, and move seamlessly between using it on either the desktop or mobile versions.

Margin and leverage trading

Traders on the platform can also access margin and leverage, which allows a trader to control larger positions with a smaller upfront investment, and can increase profits, but it can also increase risk on the futures day trading platform. Thaurus implemented various risk management tools to help users trade responsibly.

High liquidity and rapid execution

The Thaurus futures day trading platform features exceptional market liquidity, which allows traders to quickly enter and exit positions during the day with a very limited effect on price. Speed, reliability, and infrastructure are key elements of the Thaurus futures day trading platform and are critical not only to factoring several intraday strategies, but also the opportunity to respond to quick market movements.

Extensive educational materials

Thaurus provides extensive educational content, including basic guides for trading futures, tutorials on the platform, guides for developing strategies, and more. These resources will help all traders, especially beginners, understand the futures market and improve on the futures day trading platform.

Wide available futures contracts

Thaurus gives traders access to a large variety of futures contracts, which include commodities, currencies, and stock indices. The wide range of futures contracts offers traders the opportunity to build diversified portfolios and take advantage of opportunities across different types of assets all while using one futures day trading platform.

Advanced trading tools and analytics

Thaurus provides the trader with advanced tools including heatmaps, pivot points, daily trade signals and a margin calculator. These tools promote more complete analysis and inform the futures day trader on when to execute a trade. The futures day trading platform also provides market data in real-time, andcan execute trades in a timely manner, which is essential to day trading.

Strong security

Security is paramount on the Thaurus futures day trading platform. The Thaurus futures day trading platform uses state of the art security measures to ensure user funds and personal information are safe and secure for trading. The platform utilizes measures such as encryption and two factor authentication to ensure you are trading in a safe and secure environment.

Why Choose Thaurus for Futures day Trading platform?

- When opting for a futures day trading platform, traders can gain many unique advantages distinct from other trading environments. One of the biggest advantages is that traders trade with significantly higher leverage, allowing them to control larger positions using relatively small amounts of capital – sometimes even less than 5% of the value of the contract. This leverage can provide greater opportunity for even larger profits and losses, meaning that it is essential to manage risk as a futures trader. Additionally, futures day trading platforms provide nearly 24-hour access, six days a week, creating opportunities to trade based on global events and price responses in real time.

- In addition, unlike equity markets, futures trading does not have a pattern day trader rule or minimum account balances associated with margin accounts, so traders can place multiple trades a day without being restricted on the number of trades and positions. Also, there are no limitations to short selling, meaning that trader can go long or short without any inconvenience, benefiting in both up and down future markets. Finally, the major futures markets are highly liquid, substantially reducing the transaction costs associated with a traders maintaining a position, which is very important as an active day trader. Furthermore, futures day trading platforms afford traders the opportunity to access assets from an array of classes including commodities and indices that support portfolio diversification and different trading opportunities.

How to Get Started with Thaurus?

Step 1: Educate yourself

First, understand the essentials of what a futures market is and how it works, the terms, and some trading concepts. Thaurus has a whole host of educational resources to get you started with trading futures.

Step 4: Fund your account

Deposit money into your Thaurus trading account with the available options, which include bank transfers and credit/debit cards. Check for fees for funding your account.

Step 7: Begin trading

With a funded account and strategy in place, start trading futures contracts on Thaurus. Place buy or sell orders on the platform in accordance with your plan.

Step 2: Define your trading goals

Define what you are trading for and measure your tolerance for risk. A distinct trading plan may be developed by considering available capital, time commitment, and defined goals.

Step 5: Select your futures contracts

Explore the various futures contracts available on Thaurus and select which markets you will trade. These can include commodities, currency pairs, or stocks.

Step 8: Monitor and adapt

Log all your trades and alterations in market conditions, then work through revisiting your strategy when needed. Use the risk management tools available like stop-loss limit orders to protect your capital.

Step 3: Open a Thaurus account

Further, head to Thaurus‘ website and proceed with account opening. You will be asked for personal information and undergo identity verification. Make sure you go through the terms and conditions properly before proceeding

Step 6: Develop a trading strategy

Design a full trading plan that includes your entry and exit points, risk management methods, and the percentage of capital you are ready to risk in any one trade. Consider backtesting your strategy using historical data or practising paper trading.

Step 9: Stay informed

Stay abreast of market news and economic indicators that could impact on your trades. A very long-term successful futures trader will do this, for continuing education and flexibility to adapt are paramount.

Futures Trading Tools

There are several powerful tools available for futures traders to analyze market data and make informed trading decisions. Here are some of the best futures trading tools:

Technical analysis tools

eSignal offers an excellent opportunity for functionality, ranging from customizable charting and technical analysis studies to backtesting with integration with different brokers’ real-time data. MetaStock has a rather long list of technical indicators—more than 150—and allows for creating and testing customer strategies. TrendSpider is a web-based, all-in-one easy-to-use tool that automatically conducts advanced technical analysis and charting of financial markets.

Market scanners and screeners

MarketGear allows traders to identify potential trading opportunities with customizable scanning features and indicators based on technical criteria. Charles Schwab Screener Plus allows traders to filter stocks and ETFs through numerous filtering criteria so that profitable-looking trading opportunities can be easily identified.

Third-party trading applications

Some third-party apps can be integrated with the trading platform. They incorporate added features such as strategy generation, trading signals formation, and advanced technical indicators.

Advisory services

Independent trading advisory services deliver key insights in the form of research, thorough market reports, actionable trading ideas, etc., which assist the trader in keeping abreast of the changing market scenario.

Brokerage tools

Many brokerage firms offer proprietary tools, along with advanced analytics, learning, and market insights. Working with a knowledgeable broker can also enable personalized insights to fine-tune trading strategies.

Educational materials

Many platforms are now coming up with intensive education resources, including courses on the fundamentals of trading in futures, technical analysis, and market strategies, which are important for a trader to have an in-depth understanding of the markets.

Why Choose Thaurus forFutures Trading?

Thaurus steps in as one of the most preferred ways to access a futures trading platform that would help both new and seasoned traders reaping several benefits. First in line, Thaurus enables easy and 24-hour access to markets from anywhere having an internet connection. In geographical terms, its broad variety of futures contracts across several asset classes commodities, currency, stocks and futures. Thaurus lets a trader easily diversify their portfolios.

Clear up any confusion with our FAQs

Futures trading is the buying and selling of agreements that require the purchaser to buy and the seller to sell an underlying asset at a set price on a pre-specified date in the future. Traders often use these contracts to hedge against the fluctuation in prices or to speculate on market movements.

Thaurus is an online platform used to trade futures contracts. It provides traders with the opportunity to purchase an agreement for the selling or buying of assets at dates in the future, and the same uses margin accounts to help one to control his or her investment. This interface avails several markets to the user within which trades can be executed.

Tharus offers several benefits, including a user-friendly interface, advanced security measures, real-time market data, and comprehensive educational resources. Additionally, it provides fast trade execution, a variety of trading tools, and responsive customer support, making it suitable for both novice and experienced traders.

Benefits of using Thaurus as a future trading platform include:

- User-friendly interface: Easy navigation for both novice and experienced traders.

- Access to multiple markets: Trade a variety of futures contracts.

- Leverage options: Ability to control larger positions with a smaller capital outlay.

- Risk management tools: Features to help manage and mitigate trading risks

Forex trading carries several risks, including market volatility, leverage risk, and the potential for significant financial loss. Traders can experience rapid price changes, and the use of leverage can amplify both profits and losses. It is crucial to implement risk management strategies to mitigate these risks.

Yes, Thaurus typically offers mobile trading capabilities, allowing users to access their accounts and trade on the go through a mobile app or a mobile-optimized website. This feature provides flexibility and convenience for traders who want to manage their positions from anywhere.

To start trading futures on Thaurus, you need to:

- Open an account: Register on the Thaurus platform.

- Complete verification: Provide necessary identification and documentation.

- Fund your account: Deposit the required initial margin to begin trading.

- Start trading: Use the platform to place orders for futures contracts

Futures trading carries several risks, including:

- Market Volatility: Prices can fluctuate dramatically, leading to potential losses.

- Leverage Risks: While leverage can amplify profits, it also increases the risk of significant losses.

- Counterparty Risk: The risk that the other party in the contract may default on their obligation

Yes, Thaurus provides a mobile-friendly platform that allows users to trade futures contracts on their mobile devices, ensuring that traders can manage their positions on the go.

Thaurus provides multiple customer support options, including:

- Live chat: Instant support through the platform.

- Email support: Assistance via email for more detailed inquiries.

- Help center: A comprehensive resource with FAQs and guides to assist users in navigating the platform.