Why Use Trading Tools & Calculators?

Accurate risk management

- Trading calculators and tools assist you in determining accurate stop-loss and take-profit prices, so that you never stand to lose more than your defined limit for every trade. This minimizes emotional decision-making and safeguards your capital.

- Thaurus offers sophisticated AI-based risk management features and tailored signals, facilitating simpler definition and automation of your risk criteria.

Accuracy in position sizing

Calculators will do the lot or position size calculation automatically appropriate in terms of your account balance, leverage, and risk tolerance, so it will be a guess and a gamble on human errors.

Time saving & efficiency

Computerized software performs complex calculations in seconds, and you can act on market opportunities quickly and powerfully. Thaurus's intuitive interface and AI-powered app make it easy to analyze and execute trades, saving you valuable minutes.

Less human error

Manual calculations are subject to errors that can cause expensive losses. Trading calculators do math for you, maintaining precision in every transaction. Thaurus combines AI-based analytics and calculators to reduce errors and enhance the dependability of your trading decisions.

Disciplined & persistent trading

Tools stick to your trading plan by adhering to fixed risk, reward, and position size rules, which keep you consistent and disciplined. Thaurus's AI mentorship and learning resources ensure discipline in your trading and continually improve your trading strategies over a period.

Confidence through data

Being aware of your exact numbers well in advance prior to initiating a trade builds up confidence in you and reduces indecision, thus leading to better execution. Thaurus offers you real-time market analysis, artificial intelligence-based signals, and at-your-beck-and-call expert guidance so you can trade more confidently.

Key features of our advanced trading tools

Thaurus’s advanced trading tools are designed to offer traders a winning edge by employing real-time market analysis and sound risk management capabilities. The platform offers minute-to-second market data, live prices, and a complete set of technical indicators and charting solutions, thus enabling users to analyze trends, spot opportunities, and make sound decisions quickly as market conditions evolve.

Real-time market analysis

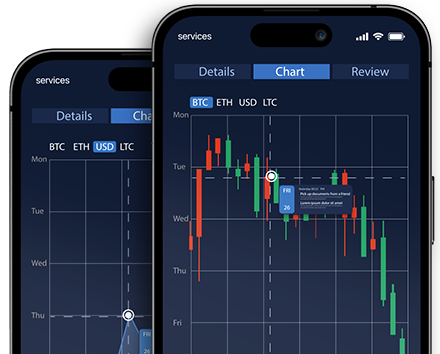

Thaurus delivers sophisticated real-time market analysis as its foundation, offering active traders live, current quotes and up-to-the-minute market information on a broad variety of financial instruments. The platform brings together powerful technical indicators, drawing tools, and alerts, all customizable and accessible, to help users follow market direction, identify trading opportunities, and respond instantly to news events or price action. All of this capability is in the palm of users’ hands through a convenient and accessible desktop and mobile platform. Traders are able to make informed choices and adjust strategy as needed, from anywhere.

Risk management & position sizing

Thaurus offers traders advanced risk management and position sizing features, including stop-loss limits, profit/loss calculators, and a margin calculator for a specific amount. These features allow users to control their exposure, calculate ideal trade sizes in terms of available capital and risk tolerance, and avoid excessive losses. The system dynamically adjusts position sizing according to real-time account balances and market conditions, encouraging disciplined trading and efficient use of capital. This enables traders to control risk actively and sustain long-term trading profitability.

How our tools improve your trading strategy?

Instant data-driven decision making

Thaurus tools offer real-time market analysis and live quotes so you can make smart decisions based on the most current data instead of old information. With advanced charting, technical analysis tools, and up-to-the-minute news feeds, you can spot trends in the market in real time and capitalize on emerging opportunities. Having access to correct information in real-time allows you to adjust your trading plan in the moment, stay competitive, and avoid missed opportunities in volatile markets.

Improved risk management and position sizing

Thaurus incorporates strong risk management capabilities like stop-loss and take-profit orders, profit/loss calculators, and exposure controls. These enable you to define accurate risk parameters for every trade so that you never overexpose your capital. By calculating optimal size positions and providing unambiguous instructions, Thaurus minimizes the potential for massive losses and enables disciplined, persistent trading, necessary to guarantee long-term profitability.

Expert-verified trading signals

Thaurus provides each day’s trading signals based on a combination of technical, fundamental, and sentiment analysis. They come with suggested entry and exit points, together with stop-loss and take-profit levels, conserving you precious hours of market analysis. Expert-validated signals enable you to spot high-probability trades and enhance decision-making, be it as an independent strategy or in conjunction with your own analysis.

Effective and dependable trade execution

With Thaurus, you get a simple-to-use interface and quick, secure trade execution. There are multiple order types and low latency, so you can enter and exit trades exactly when you want, minimizing slippage and optimizing the performance of your strategy. This speed is crucial in volatile markets, where timing can make a big difference in your outcome.

Tools and resources

Discover the essential trading tools and resources

To navigate these dynamic markets effectively, investors and traders rely on a wide range of tools and resources designed to analyze market trends, monitor financial news, and execute trades efficiently.

Don't miss out on the great market opportunities

Join the world of trading and start building your wealth today!

FAQ's

Trading calculators are computer programs that assist traders in rapidly calculating important trade metrics such as potential profit/loss, optimal position size, margin requirements, and risk-to-reward ratios. They perform sophisticated calculations automatically, conserving time and minimizing errors, so traders can concentrate on strategy instead of mathematics.

Risk management tools assist traders in managing losses through the placement of stop-loss and take-profit levels, determination of optimal position sizes, and exposure management. Risk management tools foster disciplined trading, shield capital, minimize emotional trading, and enhance long-term profitability.

There are free versions of most trading calculators and simple risk management tools offered on sites such as Thaurus. But personalized service or high-end features may come with subscriptions or minimum deposit account types.