How Our Forex Day Trading Signals Work

Step 1: Signal generation

Signals are actually generated based on a combination of technical analysis, fundamental analysis, and market sentiment evaluation. In other words, analytical process starts with analyzing price charts, significant news events, economic indicators that might cause currency fluctuations. Signals integrate all the three methods together to generate a multidimensional view of the potential market opportunities.

Step 2: Types of signals

Thaurus offers a vast array of signal types fitting specific trading requirements: Technical Signals: According to chart pattern and statistical indicators that signal possible price movements. Fundamentals: Economic news and financial reports that could affect the dynamics of the market. Hybrid Signals: These integrate both technical and fundamental analyses into a more holistic trading strategy.

Step 3: Delivery method

Signals are sent through various channels like email, SMS, and specifically designed trading platforms for the purpose of trading. In this manner, a multi-channel approach can be used to send real-time signals to traders so that they may quickly capitalize upon an emerging market opportunity.

Step 4: Trade recommendations

Every signal gives specific recommendations that specify both entry and exit points, along with suggested stop-loss and take-profit levels. All these structured recommendations guide the traders to contain the risk elements involved and thus allow them to make the right judgmental decisions.

Step 5: Real-time updates

The Thaurus bases live feeds on the real-time facts of the market. Traders will therefore update their strategies based on recent news for the contemporary application of the strategy they use.

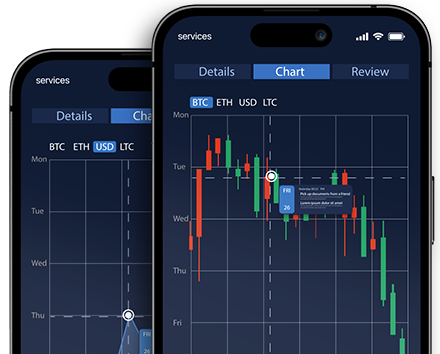

Step 6: User-friendly interface

Signal parameters and algorithms are user-friendly and easy to apply. The signals are user-friendly regardless of the trading experience of the trader.

Step 7: Testing and implementation

Trades should first test the signals on demo accounts before using them in actual trading conditions. It helps in understanding the feasibility of the signals with the risk of actual capital.

Step 8: Continuous improvement

The methodologies of these signals are constantly reviewed and optimized according to the feedback generated through market performance and that of the traders. This ensures that the signals remain effective and relevant in changing market conditions.

Why Use Our Daily Forex Signals?

Expert analysis:

Thaurus Daily Forex Signals provides the results of trading by professional traders applying technical and fundamental analysis. Thus, the expert analysis demonstrates the information the market needs-the case for timely, data-driven, trend-based decisions on the market.

Accessibility:

Thaurus Daily Forex Signals are typically communicated on most platforms. The means of communication are through email and mobile notifications, making it easy for the traders to get the updates directly or quickly act on opportunities.

Real-time updates:

The updates of signals in real-time usually include the prevailing conditions in the market, which are given in real-time so that traders can respond to changes in scenarios.

Efficiency of time:

Thaurus signals directly give both entry and exit points, thereby saving the trader a lot of time that could have been used in analyzing the market. Trades can thus be executed instead of being concerned with monitoring the constant movements of price.

Risk management:

Risk management is also another signal that includes guidelines on how to set the right risk parameters for traders, thus reducing the chances of major losses. This kind of structure has been elemental in sustaining long-term profitability for forex trading.

Improved decision making:

With well-researched signals, a trader can strengthen his decision-making process. The signals include recommendations for stop-loss as well as take-profit levels, therefore allowing the effective management of risk.

Adaptability:

The signals from Thaurus can be used as an independent trading strategy, or it can be mixed with any other trading plan according to requirement. It will allow the traders to be flexible according to individual trading styles and preferences.

Advantages of Using Day Trading Signals with Thaurus

Time management:

Thaurus day trading signals save you the precious time that would be wasted in case a trader analyses each deal by offering pre-analyzed trade opportunities. You therefore save yourself the hours spent monitoring the market to know when to take a certain trade.

Expert insights:

Technical and fundamental analysis by experienced analysts generate the signals. Such expert insights have been helpful to traders in making reliable decisions, as informed decisions enhance the probability of a trade going through successfully.

Improved decision-making:

The Thaurus signal may help a trader avoid some emotional decisions by following the signals. In this way, there will clearly be points of entry and exit for a trader, which might ease the entire process of trading and reduce psychological factors like fear or greed.

Risk management:

Every signal often comes with appropriate stop-loss and take-profit recommendations, that go along with it. These are ways of managing your risk while still trying to make profits.

Real time update

Thaurus provides real-time market conditions updates to a trader, keeping him up to date with the latest happenings to enable him to adjust his strategy accordingly. This is very crucial in the fast nature of forex.

Accessibility:

Signals can come in different media, for example, via mobile devices and email, hence a trader can receive and act timely on opportunities irrespective of their locations.

Community support:

Many signaling services, including Thaurus, provide a community base in which traders share their experience and strategies, thus creating opportunities for all users to learn from and work with each other.

Flexibility:

The traders can use the Thaurus signals as a standalone strategy or can fit them into the existing trading plans, thus accepting flexibility based on individual trading styles and preferences.

Best Practices for Using Day Trading Signals

Understand the signal provider

Research the track record, methodology, and transparency of your chosen signal provider. You should choose a professional one that can help you develop profitable signals. He should further disclose his or her risk management practices, such as stop-loss levels and position sizing.

Integrate signals with your own analysis

Use signals as an added information source in addition to your technical and fundamental analysis. Always get confirmation for your personal trading setup from signals. Just do not wait for signals blindly but understand why they bring that signal. So, design your trading plan and decision-making process on your own.

Manage risk carefully

Set stop-loss according to your own risk appetite and recommendations from the signal providers. Never risk more than you can afford to lose. Divide your trading capital across multiple signals and asset classes. You never want to over-leverage or over-trade based on a single signal.

Test signals before live trading

Paper trade or use the demo account to test the performance of these signals before risking real capital. Analyze how accurate, consistent, and profitable the signal is. Keep monitoring and also making changes according to the performance of these signals under varying market conditions for trading.

Avoid emotional trading

Stick to your trading plan and strategy based on signals. Do not let fear and greed condition your judgment in the trade. Wait for the higher-probability setups. Do not make a trade based just on signals and go with the flow.

Stay disciplined and consistent

Hold to the trading plan and signal-based strategy consistently and avoid deviation based on short-term results. Therefore, keep on learning their trading techniques and market dynamics to improve the decision-making process.

FAQ

Day trading signals refer to buy and sell alerts or recommendations generated from trading criteria variously derived from technical and fundamental analysis. It, therefore, guides traders on when to buy an asset or sell it-applying effectively to enable the trader make fast and efficient decisions.

The forex day trading signals are far from uniform in strength. Robust methodology used in generating signals makes reliability a matter of credibility, more dependable signs are forwarded by sources with proven credibility. However, these signals must be combined, wisely sorted, with the owner’s analysis of the trader to improve the decisions and to handle risks effectively.

Yes, they can easily be utilized in the forex market. Day trading signals assist the traders in understanding how the market is flowing and make them conscious to predict through which channels they can enter and leave the market profitably.

The number of forex signals delivered in the schedule may differ from one provider to another. Some providers give numerous signals during the day, while others have a permanent number of key signals they distribute depending on market conditions. The provider in question should be asked to determine the exact delivery schedule and frequency.

Don't miss out on the great market opportunities

Join the world of trading and start building your wealth today!